- Operations

Quantitative Intuitive Decision Making

How to become unconsciously competent with data

At the heart of good decision making in today’s fast and complex environment is the ability to see how things fit together—and perhaps more crucially, spot when things do not have a good or logical fit—quickly and effectively, and leverage these connections to derive insights and make prompt data-driven decisions.

Together with my colleagues, Chris Frank, a senior executive at American Express, and Paul Magnone, at Google’s cloud platform, (see also Chris and Paul’s book ‘Drinking from the Firehose’) we have noticed that managers and executives are often fearful of relying on quantitative data in making business decisions. There seems to be a misconception that in order to be able to effectively make data-driven decisions, you have to be a ‘quant’ or a ‘math wiz’. We believe that this misconception generates a lot of unnecessary stress and, more importantly, a lot of good business decisions are not being taken.

……………………………………………………………………………………………………………

This is one of a series of articles published in an inspiring eBook from Columbia Business School. To read all articles in this series…

Download the complimentary ‘Research for Action’ e-book here

……………………………………………………………………………………………………………

What sets apart better leaders is the ability to see the same data as others (and everyone sees lots of similar data these days) but make some different conclusions and derive different insights from it. The key to doing so is to learn to quickly and effectively synthesize, rather than merely summarize, the information presented. We believe and show that this does not require you to be able to solve logarithms or square roots in your head, but rather develop the ability and confidence to ask the right questions, spot patterns, and process that information in parallel with your understanding of the wider business situation.

To help managers build these skills, we have developed a concept, a framework, and a set of tools which we term Quantitative IntuitionTM. Formally, we define this as the ability to make decisions with incomplete information via precision questioning and business acumen driven by pattern recognition. This requires a parallel view of the issues that matter rather than just a logical sequence of thoughts to see the situation as a whole.

Asking the Right Questions

One of the key elements to acquiring this acumen lies in ‘precision questioning’. This is the element that we see as being least prevalent in data analysis and where the real work needs to be sweated to achieve improved performance. In today’s world, the smartest person in the room is no longer the person who has the answers, but the one who asks the right questions to get the desired outcomes. With data drowning us on all sides, the usual “Can we look at the data and see what it tells us?” is likely to lead to a long journey with little results and insights.

We offer some techniques to approach data differently, beginning with IWIK, a method from Paul and Chris’s book, which stands for what is it that “I wish I knew.” We found that starting a group meeting around data-driven decision making with this deceptively simple question is extremely effective in quickly directing the data-driven discussion on the important issues and honing in on the fundamental issue that needs to be answered. It also has the benefit of often unearthing the data required as having already been acquired and being used elsewhere, when group members say “hey, we have that already, we got it when we…”.

Driving Backwards to Move Forward

A second approach is backward data-driven decision making, where you start the data-driven journey with the decision you would be making and then extrapolate backwards to see what analysis and data you would have needed to be able to make the decision. This approach requires the manager to put in a lot of thought and energy at the outset of the data-driven process to determine what the proposed decision and analyses might be. Executives are often reluctant to spend so much time early on in the process, thinking about the problem, decision and analyses to be done, but it is a well spent effort as it almost guarantees that the data-driven process will result in actionable outcomes.

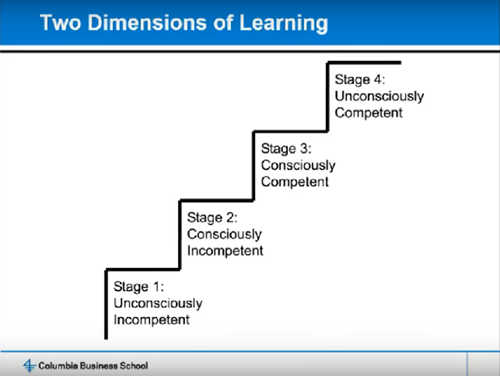

In order for Quantitative Intuition to become second nature—that is, intuitive—a series of learning steps need to be climbed. Initially, we do not know what we do not know, we are ‘unconsciously incompetent. We then become aware of what we do not know and become ‘consciously incompetent’. We can then learn it, so we become ‘consciously competent’. And finally, we use it so often that we cease to be aware of using it consciously, becoming ‘unconsciously competent’. This is the stage of intuition that we strive for in our Quantitative Intuition program.

Oded Netzer, Chris Franks and Paul Magnone will be teaching the Quantitative Intuition program at Columbia Business School this September. See here for further details.

For Further information on this topic – see:

Columbia Exec-Ed Webinar – January 2017 - https://www.youtube.com/watch?v=mXCwVEZ5q3Y

Columbia Business School is the only Ivy League institution that delivers a learning experience where academic excellence meets real-time exposure to the pulse of business in New York City.

ARTICLES YOU MIGHT LIKE

BOOK REVIEW

A practical guide to sustainable corporate sourcing and running a scandal-free supply chain

DEVELOPING LEADERS QUARTERLY MAGAZINE AND WEEKLY BRIEFING EMAILS